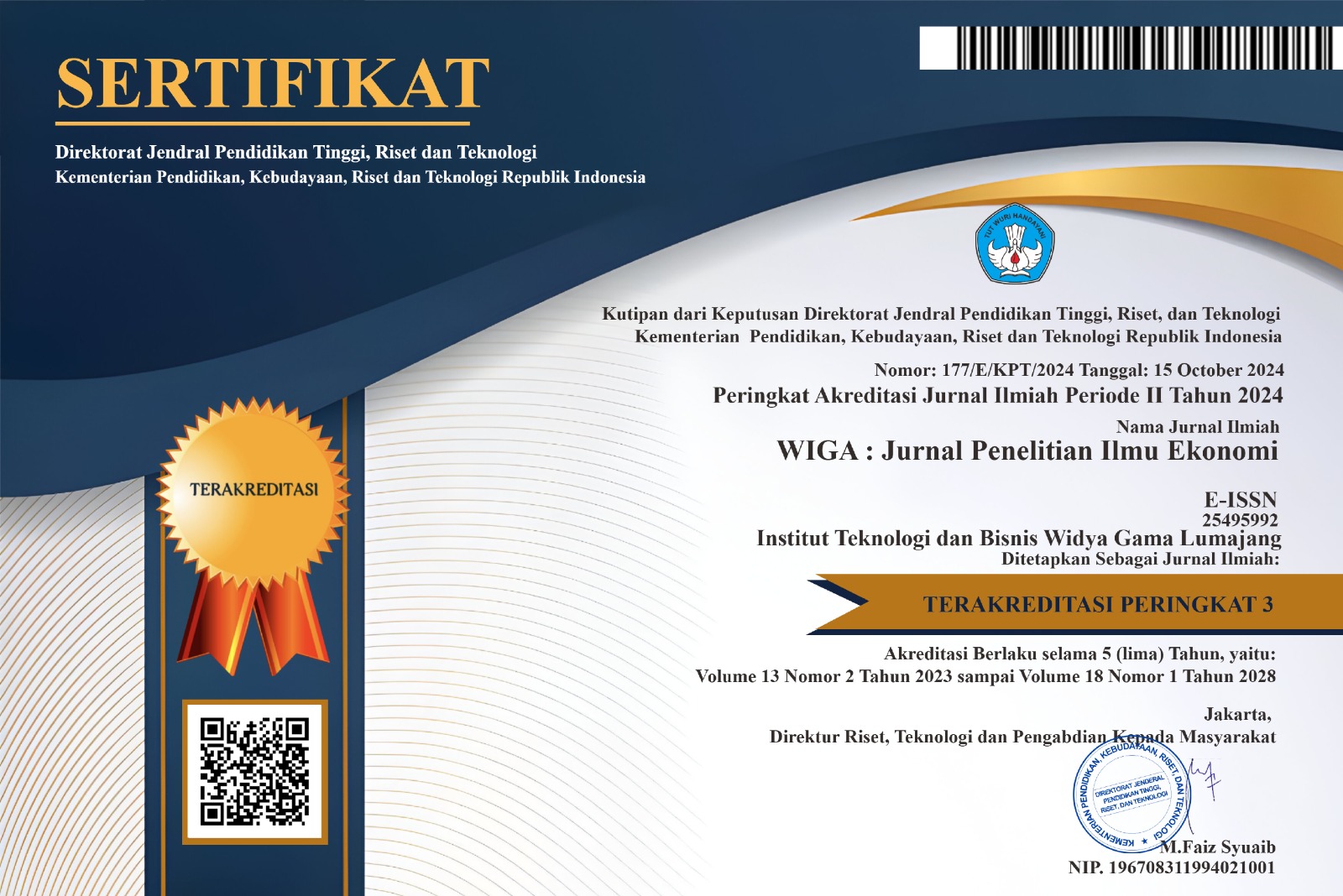

Analisis Faktor-Faktor Yang Mempengaruhi Struktur Modal Pada Perusahaan Katagori Saham Blue Chips Di Bursa Efek Indonesia Periode Tahun 2011-2014

DOI:

https://doi.org/10.30741/wiga.v6i1.94Keywords:

capital structure, the structure of assets, the ratio liability, profitability, liquidity, sales growth, and the size of the company.Abstract

The purpose of this research is to find and test influence between structure assets, the ratio debt, profitability, liquidity, sales growth, and the size of the company to structure capital companies blue chips listed on the indonesia stock exchange (IDX) a period of the year 2011-2014. This research uses the method purposive sampling. Technique the analysis used is linear regression multiple. Test a hypothesis that used is test f statistics and test t statistics, with a level α = 5 percent. This research result indicates that simultaneously structure assets, the ratio debt, profitability, liquidity, sales growth, and the size of the company is the a significant impact on capital structure. In partial structure assets, the ratio debt, and liquidity is the a significant impact on capital structure. While profitability, sales growth and the size of the company in partial there is no the effect on capital structure. Value adjusted r square of 0,298. This means that 29,8 % dependent variable the capital structure can be explained by six independent variable while the rest of 70,1 % capital structure described by variable or other causes out model.